In half 1, half 2, and half 3 of this 9 half collection …

… I taught why this technique is healthier for making an attempt to construct a small account in comparison with penny shares.

Now let’s look at HOW it really works.

Choices buying and selling BLUEPRINT for merchants with SMALL ACCOUNTS.

HOW to get 3 methods to win on each commerce.

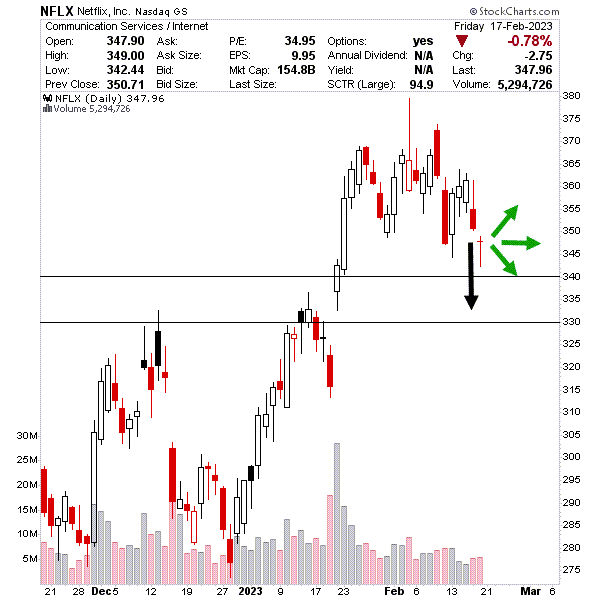

NFLX is at $348.

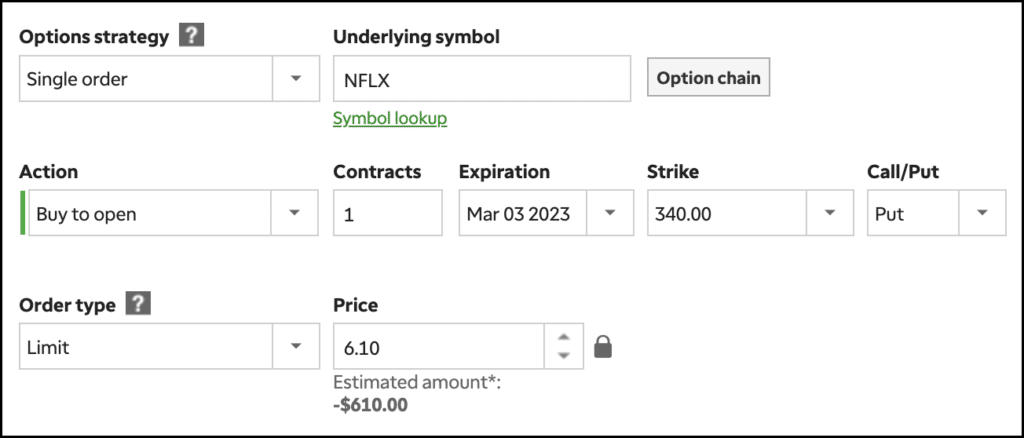

When a novice dealer buys the $340 out-of-the-money put there’s just one approach to win.

NFLX should fall under $340.

This offers them low likelihood, let’s say 30%.

That $6.10 worth of the put choice they purchased has no true worth.

It’s solely made up of time.

Each minute NFLX is above $340, that $6.10 loses time worth like a leaky bucket.

Time worth leaks on the weekends too.

Time worth at all times heads towards $0.

And it does so at its quickest price within the last 5-7 days earlier than expiration.

Unhealthy for the customer.

Nice for the vendor!

Time worth of the choice ‘leaks’ quicker and quicker as expiration approaches.

And proper into the account of the vendor.

That is why I wish to promote places 1-2 weeks away from expiration.

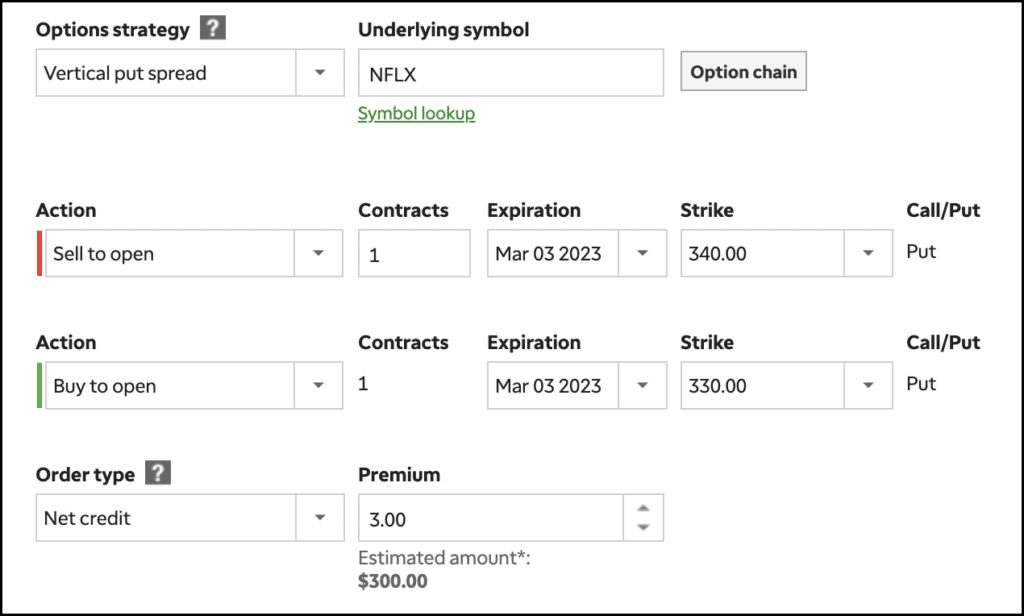

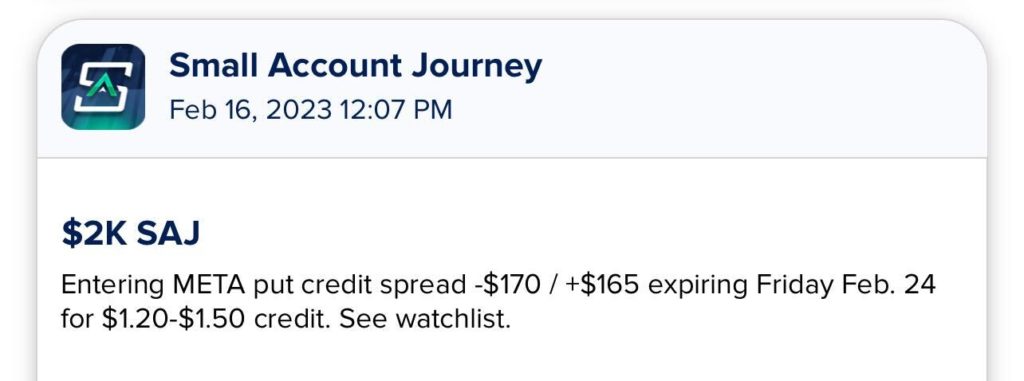

My order entry, as the vendor, would seem like this.

And I can do that with as little as a $2,000 margin account.

And it’s a restricted danger commerce with a excessive likelihood of successful.

In case you are new, don’t sweat what the order entry picture above means. Perceive the idea for now. Order entry is simple and I’ll train you that later.

Backside line.

The client of the low likelihood out-of-the-money $340 put solely has 1 approach to win → NFLX falls effectively under $340.

The vendor has 3 methods to win:

- NFLX can head decrease, however so long as it’s above $340, the vendor wins

- NFLX trades sideways, the vendor wins

- And naturally the vendor wins if NFLX heads up

Shopping for that low likelihood out-of-the-money put is betting NFLX will go down i.e. bearish.

Which implies the vendor is impartial to bullish.

Do that on latest earnings winners with sturdy steerage and likelihood will increase extra.

So why on earth would anybody purchase a $340 out-of-the-money put choice on NFLX when MIT warns you’ll lose cash?

As a result of most merchants are usually not educated.

However not you, you’re nonetheless studying.

No extra choice shopping for.

Time to show the tables and begin taking excessive likelihood trades.

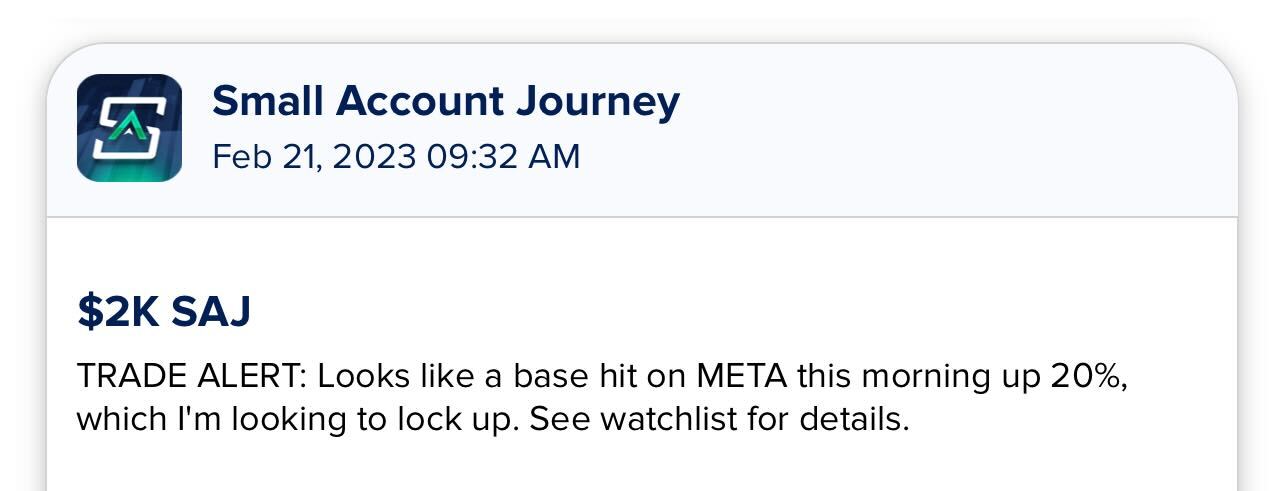

I’ll even ship you my entries and exits earlier than I get out and in of those trades.

I’ll even ship you my entries and exits earlier than I get out and in of those trades.

No technique is ideal. I’ll have losses right here. However that is the very best one I do know.

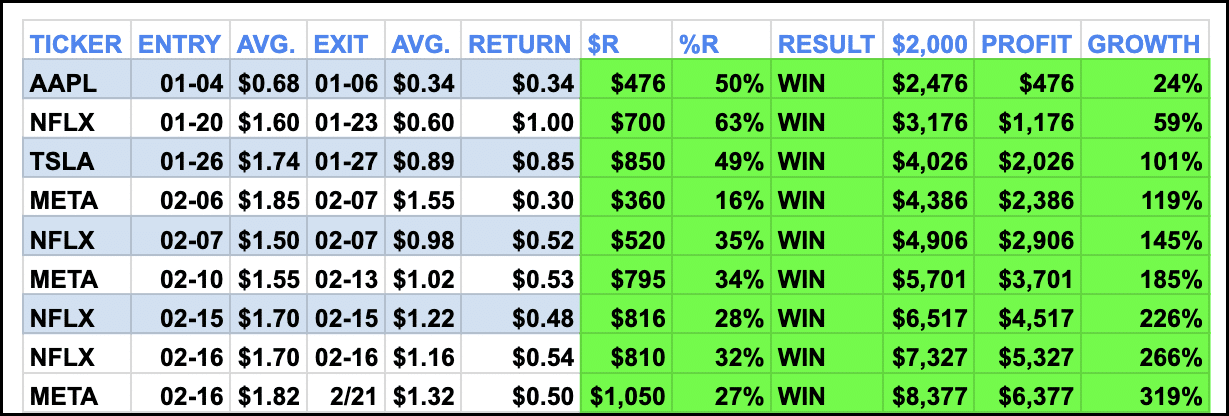

Begin your $2,000 Small Account Journey at present