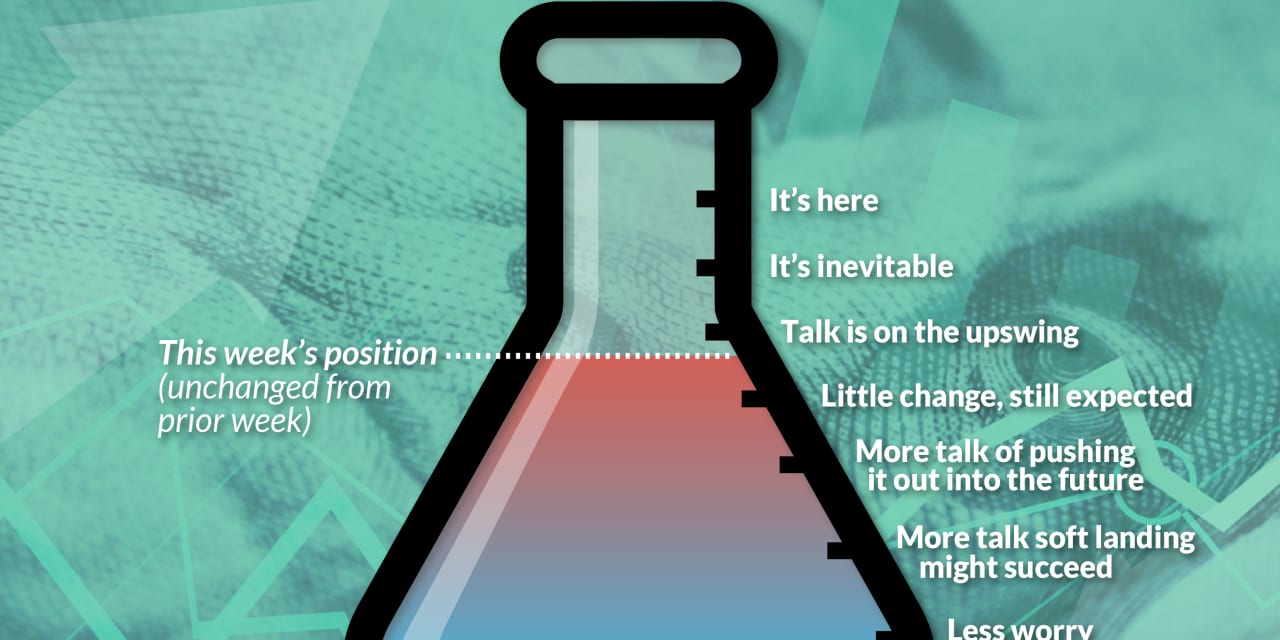

Fears of a U.S. recession stayed elevated this week, whilst some doubters have been caustic about how lengthy some economists have been apprehensive a few extreme downturn.

“A recession can’t all the time be six months away,” stated Neil Dutta, head of financial analysis at Renaissance Macro, referring to the truth that some economists have been anticipating since early 2022.

Dutta stated that economists generally tend of “falling in love” with their forecast, and stated “it’s clear that some are having bother letting go.”

Dutta stated actual incomes are advancing and the drag on housing is fading.

However recession fear warts assume the present energy of the economic system, regardless of the Federal Reserve’s 5 share level enhance in its coverage rate of interest previously yr is what has them probably the most apprehensive.

They assume the Fed goes to should maintain tightening financial coverage till there may be ache in monetary markets and the actual economic system.

“Perhaps the recession is delayed, however I nonetheless assume it’s going to be onerous to keep away from,” stated Jim Baird, chief funding officer at Plante Moran Monetary Advisors.

“The Fed has a propensity to interrupt the economic system by elevating rates of interest till they achieve this,” he added.

Nearly each indicator for the U.S. economic system landed on the sturdy aspect of expectations this week, famous Sal Guatieri, senior economist at BMO Capital Markets, in a be aware to shoppers.

This appeared to encourage Fed Chairman Jerome Powell throughout his European tour that two extra charge hikes are coming.

“Should you imagine the complete results of upper charges are nonetheless to return, you may’t rule out a

tougher touchdown for the economic system. We nonetheless search for a light stoop, although the timing

stays doubtful given ongoing assist from a number of buffers. For now, we’ll persist with the second half of the yr as a placeholder,” Guatieri added, in a be aware to shoppers.

See additionally: U.S. economic system on observe to develop as quick as 2% within the second quarter