Friday futures present that after a stumble within the earlier session, shares will as soon as once more be on the entrance foot when the opening bell rings on Wall Road.

Nevertheless, the decline on Thursday illustrates how weak a market can all the time be to sudden sell-offs after rallying so arduous.

Alertness and nimble considering is required. Denise Chisholm (no relation), director of quantitative market technique at Constancy, says that buyers needs to be cautious of relying an excessive amount of on their intestine instincts, so she analyzes market historical past to uncover patterns and possibilities that may assist inform the present outlook.

And Chisholm has give you what she says are three stunning investing concepts to think about now.

First, tech shares and why the present rally may have endurance. The S&P Know-how Choose Sector index by late this month had gained some 40% for the yr so far, but this surge got here as earnings for the sector declined within the 12 months by way of Might, she notes.

Chisholm checked out different intervals when tech outperformed even because the sector’s earnings fell and located the market traditionally has been good at anticipating earnings rebounds for tech.

“In truth, after 12-month intervals when tech earnings have fallen however tech shares have outperformed, the sector’s earnings then went on to greater than double over the following 12 months on common, primarily based on information going again to 1962. And the shares outperformed the broad market by a mean of seven share factors throughout these intervals,” says Chisholm.

“Previous efficiency isn’t a assure of future outcomes. But when tech shares have been surging in anticipation of an earnings restoration, then it’s attainable this tech rally may have room to run,” she provides.

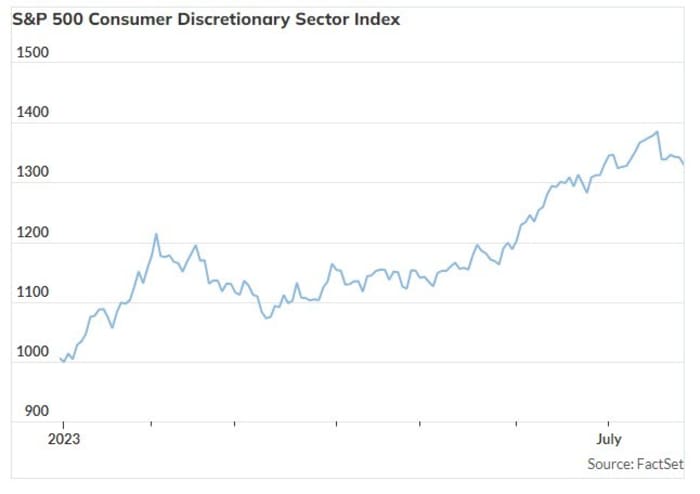

Subsequent, shopper discretionary shares. Though purveyors of non-essential items could also be anticipated to battle throughout an financial downturn, Chisholm sees three causes to be bullish.

The sector is trying low cost, with its price-to-book ratio relative to that of the broader market within the backside 25% of its historic vary, as little as it was in the course of the pandemic in 2020. “After buying and selling at related ranges up to now, the sector has outperformed the market by a mean of 4 share factors over the next 12 months,” says Chisholm.

Falling inflation permits households to spend extra on non-essential items and providers. The patron discretionary sector outperformed the market 70% of the time when contemplating rolling 12-month intervals when inflation was cooling.

Additionally, the present tightness of financial institution lending — the sector’s willingness to lend this spring hit the underside 10% of its vary for the reason that mid-1960’s — could appear dangerous for shopper discretionary, however traditionally has served as a contrarian indicator.

“When financial institution willingness to lend hit the underside 10% of its vary up to now, shopper discretionary went on to beat the market greater than 75% of the time over the following 12 months—the most effective odds of any sector,” says Chisholm.

Lastly, there’s industrials, the place the arrange is much like shopper discretionary. Within the second quarter, industrials’ relative price-to-book ratios dropped to the bottom 25% of of its historic vary. “After bottom-quartile relative valuations traditionally, the sector outperformed the market over the following 12 months greater than 70% of the time,” says Chisholm.

As well as, the newest Institute for Provide Administration manufacturing new orders index dropped to the bottom 5% of its historic vary since 1962. That makes it simpler to beat expectations, and traditionally the index’s fall to such ranges additionally left industrials with a greater than 70% likelihood of beating the market over the following 12 months.

“To make sure, there’s no scarcity of financial headwinds, and previous efficiency isn’t any assure of future outcomes. However my analysis suggests causes to stay optimistic on the inventory market—and particularly on the expertise, shopper discretionary, and industrials sectors,” Chisholm concludes.

Markets

U.S. stock-index futures

ES00,

NQ00,

are increased as benchmark Treasury yields

TMUBMUSD10Y,

dip. The greenback

DXY,

is little modified, whereas oil costs

CL.1,

slip and gold

GC00,

goes increased.

Strive your hand on the Barron’s crossword puzzle and sudoku video games, now working every day together with a weekly digital jigsaw primarily based on the week’s cowl story. To see all puzzles, click on right here.

The excitement

Two information factors which are carefully watched by the Fed as gauges of underlying inflationary pressures within the financial system can be launched on Friday. The core private consumption expenditure index for June and the employment value index, for the second quarter, can be printed at 8:30 a.m. Japanese.

Different financial information on Friday embrace the July shopper sentiment survey at 10 a.m.

The earnings season rumbles on. Amongst these presenting their outcomes on Friday are Exxon Mobil

XOM,

whose shares are a contact softer after lacking revenue estimates. Procter & Gamble

PG,

shares are up 2% after worth rises helped it beat forecasts, Chevron

CVX,

and Colgate-Palmolive

CL,

shares are little modified.

Intel inventory

INTC,

is leaping greater than 6% in Friday’s premarket motion after the corporate mentioned PC and data-center gross sales beat expectations.

Roku shares

ROKU,

are up 10% after the streaming-media firm’s earnings and outlook exceeded forecasts.

Enphase Power’s

ENPH,

inventory is tanking 16% after the corporate reported income that fell wanting analysts’ estimates and supplied a weak forecast.

The Financial institution of Japan confirmed that it was tweaking its yield curve management coverage, sparking volatility within the yen

USDJPY,

and pushing 10-year authorities bond yields

TMBMKJP-10Y,

at one level to their highest since 2014.

Better of the online

5 ways in which shopping for a automotive has drastically modified.

Tesla created secret workforce to suppress hundreds of driving vary complaints.

The chart

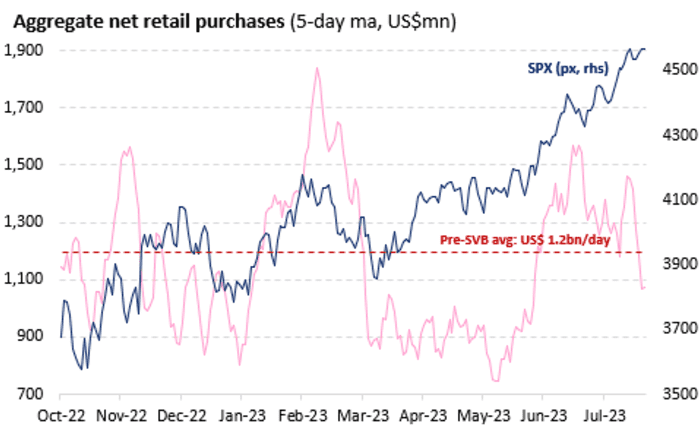

Retail buyers have been cautious of the newest a part of the inventory market rally, information from Vanda Analysis suggests.

“Over the previous 5 buying and selling classes ending Wednesday, retail merchants purchased a mean of $1.08 billion price of securities per day, considerably dipping under the post-Covid every day common of $1.2 billion for the primary time since early Might. This isn’t all dangerous information for U.S. equities as retail’s pullback seemingly implies that stickier institutional capital has supported the more moderen leg of the rally…Seasonality and thematic rotations are behind the latest decline in general web retail purchases,” says Vanda.

Supply: Vanda Analysis

High tickers

Right here had been probably the most lively stock-market tickers on MarketWatch as of 6 a.m. Japanese.

| Ticker | Safety identify |

|

TSLA, |

Tesla |

|

NIO, |

NIO |

|

AMC, |

AMC Leisure |

|

TUP, |

Tupperware Manufacturers |

|

NVDA, |

Nvidia |

|

GME, |

GameStop |

|

INTC, |

Intel |

|

AAPL, |

Apple |

|

META, |

Meta Platforms |

|

AMZN, |

Amazon.com |

Random reads

With youth unemployment excessive, meet China’s full-time kids.

Right here’s what might be the world’s tallest cat

King Charles loved his pie-based doppelganger

Must Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your electronic mail field. The emailed model can be despatched out at about 7:30 a.m. Japanese.

Hearken to the Finest New Concepts in Cash podcast with MarketWatch monetary columnist James Rogers and economist Stephanie Kelton