Subsequent Bitcoin Halving Simply Over One 12 months Away – Right here’s What Might Occur to the BTC Worth

The subsequent Bitcoin halving, the place the BTC reward delved out to community validators per block mined shall be halved, is developing in simply over one 12 months and this might be a key theme within the Bitcoin market within the coming quarters. That’s as a result of previous halvings have constantly had an enormous value influence.

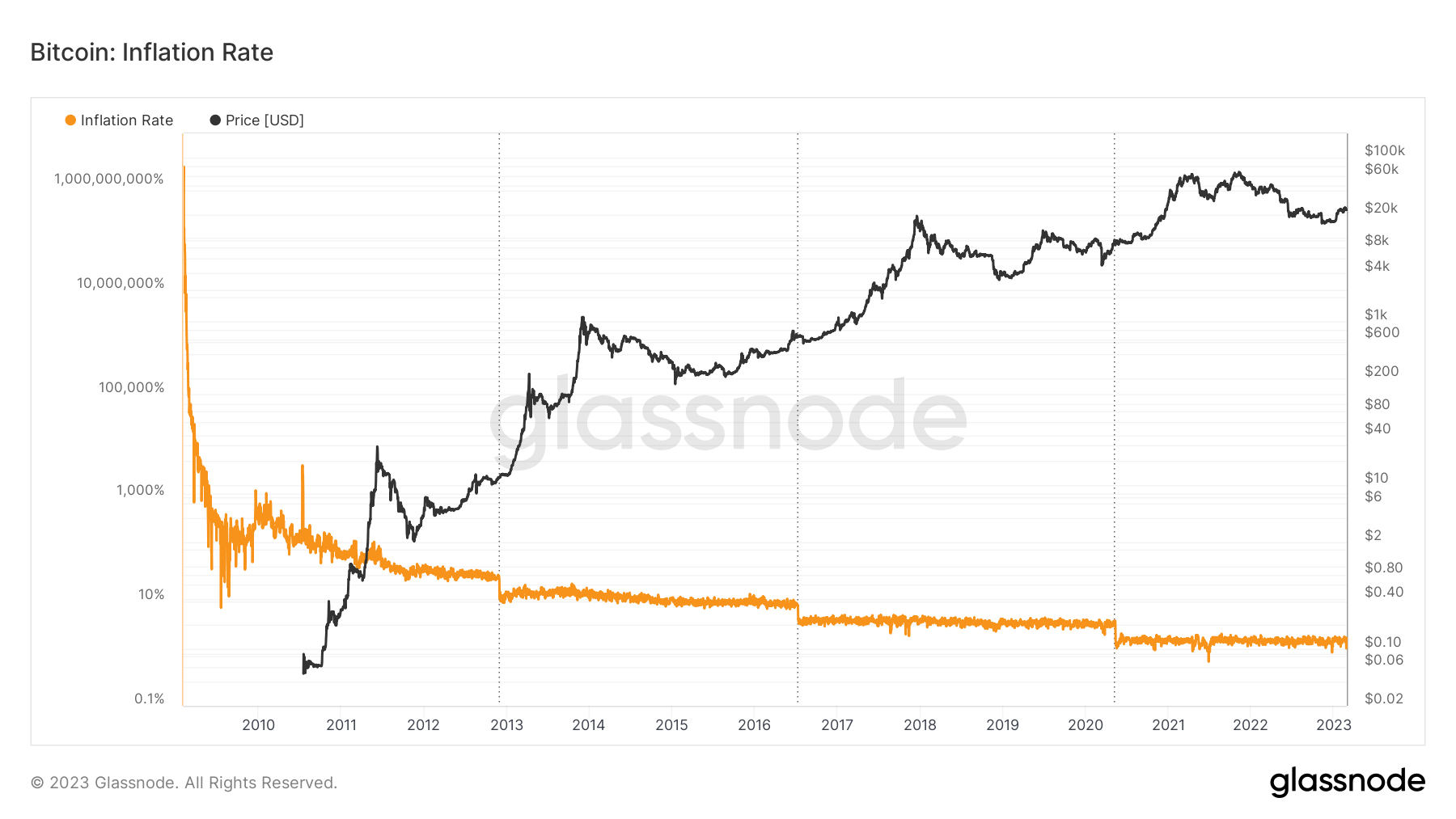

For reference, the present Bitcoin block reward is round 6.25 BTC, with blocks taking a mean of round 10 minutes to mine. In April 2024, this block reward shall be slowed to three.125 BTC, slowing Bitcoin’s inflation fee from round 2.0% to round 1.0%. Bitcoin’s inflation fee is designed to proceed falling and tends in direction of zero with a view to make sure that the BTC provide by no means surpasses 21 million.

Halvings Usually Proceed a Ferocious Rally

There have to date been three Bitcoin halving occasions, the primary in November 2012, the second in July 2016 and the newest one in April 2020. All three have proceeded huge run-ups within the Bitcoin value. On the time of the 2012 halving, Bitcoin was buying and selling round $12. Inside round one 12 months, it had rallied above $1,000.

The second halving befell when Bitcoin’s value was round $650. Inside lower than a 12 months and a half, Bitcoin’s value had reached $19,000. Lastly, within the 2020 halving befell when Bitcoin’s value was beneath $9,000. Costs then went on to hit file highs in November 2021 of $69,000.

Bitcoin has thus posted positive aspects from the date of the halving to the subsequent market peak of roughly 83x, 29x and 8x. Unsurprisingly, with Bitcoin maturing as an asset class and having loved substantial progress in its market capitalization, the speed of its post-halving positive aspects has slowed and will but sluggish additional.

Perhaps the 2024 halving may end in a extra modest 2-3x achieve when taking a look at Bitcoin’s peak value within the post-2024 halving interval. With a litany of on-chain and technical indicators all screaming that 2022’s bear market is over and 2023 off to an excellent begin for the world’s largest cryptocurrency by market capitalization, a continued gradual restoration in 2023 and into 2024 would possibly properly be on the playing cards, regardless of ongoing macro/liquidity headwinds from the Fed’s tightening efforts.

Say Bitcoin is ready to get better to the $30-40K area by the point of the subsequent halving. We may then properly be taking a look at a post-halving rally to the north of $100K.

Different Fashions Level to Lengthy-term Bitcoin Upside

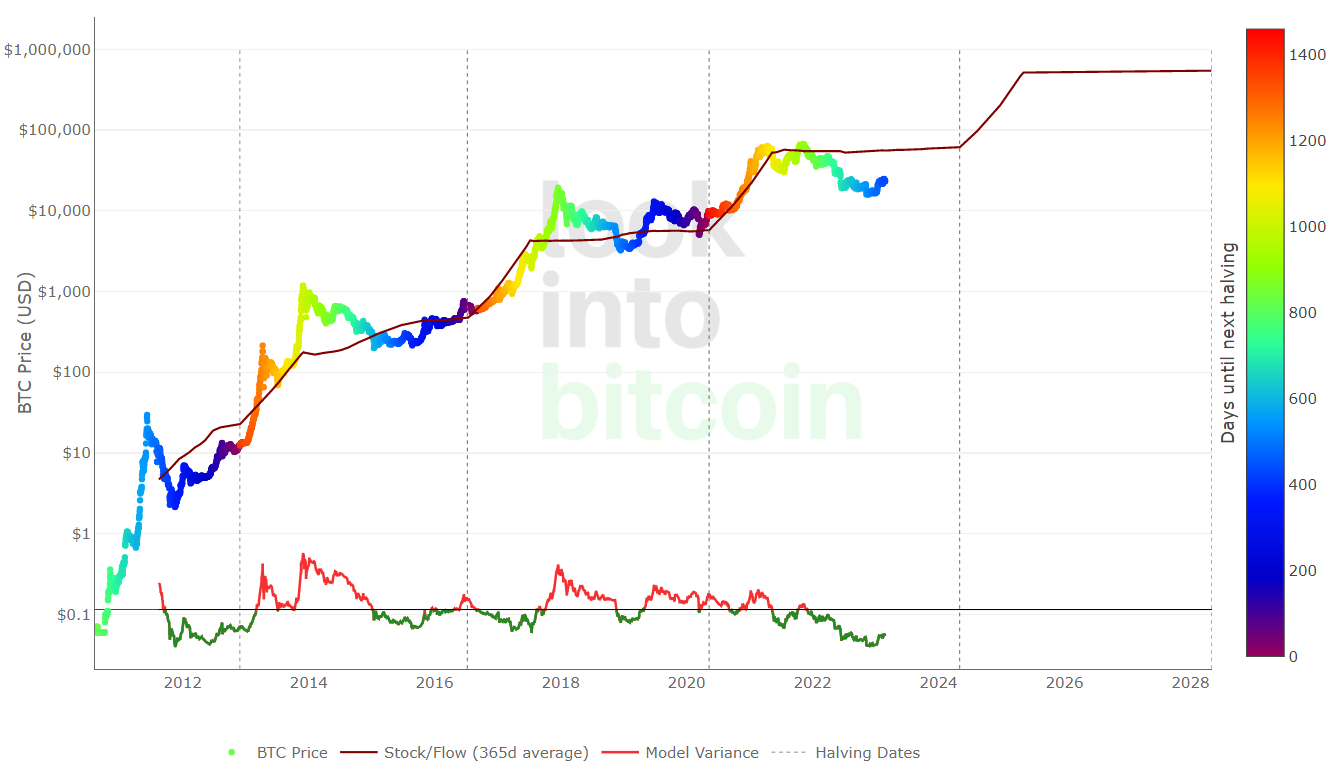

A lot of extensively adopted long-term Bitcoin pricing fashions/forecasting instruments are rather more bullish on Bitcoin than the above again of the fag field evaluation. In accordance with the extensively adopted stock-to-flow, which exhibits an estimated value degree primarily based on the variety of BTC out there out there relative to the quantity being mined every year, Bitcoin’s truthful value proper now could be round $55K and will rise above $500K within the subsequent post-halving market cycle. That’s round 20x positive aspects from present ranges.

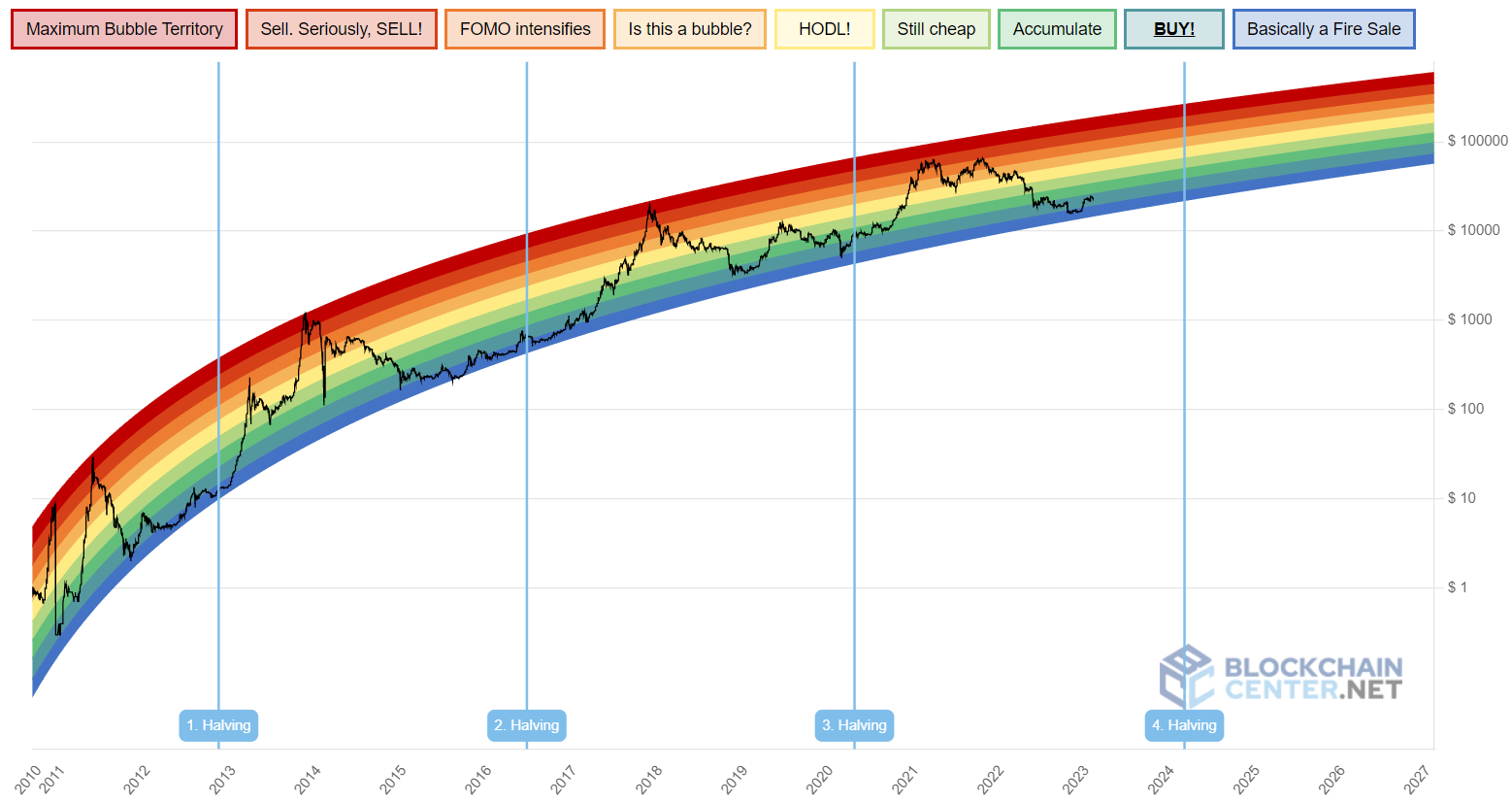

In the meantime, Blockchaincenter.internet’s in style Bitcoin Rainbow Chart exhibits that, at present ranges, Bitcoin is within the “BUY!” zone, having not too long ago recovered from the “Mainly a Fireplace Sale” zone in late 2022. In different phrases, the mannequin means that Bitcoin is regularly recovering from being extremely oversold. Throughout its final bull run, Bitcoin was capable of attain the “Promote. Critically, SELL!” zone. If it may well repeat this feat within the subsequent post-halving market cycle inside, say, one to 1 and a half years after the subsequent halving, the mannequin suggests a attainable Bitcoin value within the $200-$300K area. That’s round 8-13x positive aspects from present ranges.