Shares are rebounding on the heels of a rotten week — the worst since December for the S&P 500

SPX

and the Nasdaq Composite

COMP.

And as Wall Road analysts go darkish, with discuss of investor dying zones at Morgan Stanley, some droplets of knowledge by one of many world’s most adopted buyers, might have arrived within the nick of time.

In Warren Buffett’s annual letter — apparently one in all his shortest ever at 4,455 phrases — to Berkshire Hathaway

BRK

BRK

shareholders, he throws a bone to us mere mortals by dedicating some airtime to what he hasn’t gotten proper.

“In 58 years of Berkshire administration, most of my capital-allocation selections have been no higher than so-so. In some circumstances, additionally, unhealthy strikes by me have been rescued by very giant doses of luck. (Bear in mind our escapes from near-disasters at USAir and Salomon? I actually do.),” Buffett stated.

“Our passable outcomes have been the product of a couple of dozen really good selections –– that will be about one each 5 years –– and a sometimes-forgotten benefit that favors long-term buyers akin to Berkshire,” he stated.

Buffett then waded into the deserves of long-term investing and the “secret sauce” that has made the conglomerate fairly good at what they do. He mentioned Coca-Cola

KO,

one in all his longtime holds, noting that Berkshire accomplished a seven-year buy of these 400 million shares in August 1994.

“The whole price was $1.3 billion — then a really significant sum at Berkshire. The money dividend we acquired from Coke

KO

in 1994 was $75 million. By 2022, the dividend had elevated to $704 million. Development occurred yearly, simply as sure as birthdays. All Charlie [Munger] and I have been required to do was money Coke’s quarterly dividend checks. We count on that these checks are extremely prone to develop,” he stated.

Buffett famous that his Coca-Cola funding was value $25 billion on the finish of 2022, whereas American Categorical

AXP,

whose annual dividends have surged from $41 million to $302 million, was now value $22 billion. “Every holding now accounts for roughly 5% of Berkshire’s web value, akin to its weighting way back,” he stated.

The Sage of Omaha then turned to what would have occurred if he’d plugged cash into the same asset that had simply retained its unique worth, say $1.3 billion right into a “high-grade 30-year bond.” He stated that will have amounted to unchanged $80 million of annual revenue — a drop within the bucket for Berkshire.

“The lesson for buyers: The weeds wither away in significance because the flowers bloom. Over time, it takes just some winners to work wonders. And, sure, it helps to begin early and dwell into your 90s as properly,” stated Buffett.

Additionally: ‘You may be taught quite a bit from useless folks.’ Charlie Munger, Warren Buffett’s 99-year-old associate, doles out investing knowledge.

On Twitter, eToro’s funding analyst Callie Cox stated buyers ought to pay heed to the truth that Berkshire’s prime 5 portfolio holdings have been held for a mean of 17 years. “Wish to be the subsequent Buffett? Maintain a little bit longer,” she stated on Twitter.

“Buffett can also be vocal about how he thinks time is a aggressive benefit. For many people, investing is like planting an oak tree. You sow your seeds with the understanding that you simply gained’t see sprouts for years as a result of rising a tree takes time. As you’ll be able to see, the inventory market has been the uncommon instance of one thing that turns into extra sure with time,” she wrote in a weblog publish earlier this month.

Whereas that’s not the simplest view to carry nowadays, Cox famous that the holder of a hypothetical, no-fee S&P 500 fund for any 20-year interval since 1950, would have earned about 7% a 12 months, quite than shedding cash. “Do the mathematics — investing for 20 years at a 7% annual progress price can practically quadruple your preliminary funding.”

And buyers paralyzed by inactivity ought to keep in mind: “The S&P 500 has gone by means of 11 financial recessions over the previous seven many years, and but it’s returned a mean of 8% a 12 months since then,” stated Cox.

Learn: Are you nearing retirement? Right here’s easy methods to transition your portfolio from progress to revenue.

The markets

Shares

DJIA

SPX

COMP

are larger, whereas bond yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

are easing again, because the greenback

DXY

slips and crude costs

CL

BRN00

flip decrease.

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Enterprise Every day. Additionally learn MarketWatch’s dwell markets weblog to maintain up with the newest information.

The excitement

Seagen

SGEN

inventory is up 15% after a report that Pfizer

PFE

is reportedly in talks to amass the biotech for its focused most cancers therapies.

Shares of Li Auto

LI

are up over 4% after the China-based electrical car (EV) maker’s revenue got here in additional than double what was anticipated.

Chevron

CVX,

Occidental Petroleum

OXY,

Coca-Cola , American Categorical are amongst eight firms that counted Buffett’s Berkshire Hathaway as their greatest investor in late 2022. However the conglomerate on the weekend additionally revealed an 8% working earnings fall on account of underperformances by railroads. Talking of, Union Pacific will hunt for a brand new CEO after strain from a hedge fund.

Earnings season will not be fairly over, with outcomes due this week from massive names in retail — Goal

TGT,

Greenback Tree

DLTR,

Lowe’s

LOW,

Finest Purchase

BBY,

alongside meme-favorite movie-chain proprietor AMC

AMC.

And: How massive is the storm in cloud software program? Salesforce, Zoom and Snowflake are about to inform you.

January sturdy items orders fell 4.5%, a deeper-than-expected contraction. Nonetheless o come are January pending house gross sales at 10 a.m., adopted by remarks from Fed Governor Phillip Jefferson at 10:30 a.m.

Better of the online

‘We simply put on blankets’: Inside Britain’s outrage over power costs and the most important industrial motion in many years

How Switzerland is beating rampant inflation elsewhere.

One laid-off tech employee’s odyssey: 5 months, 25 interviews and 100 job functions

The chart

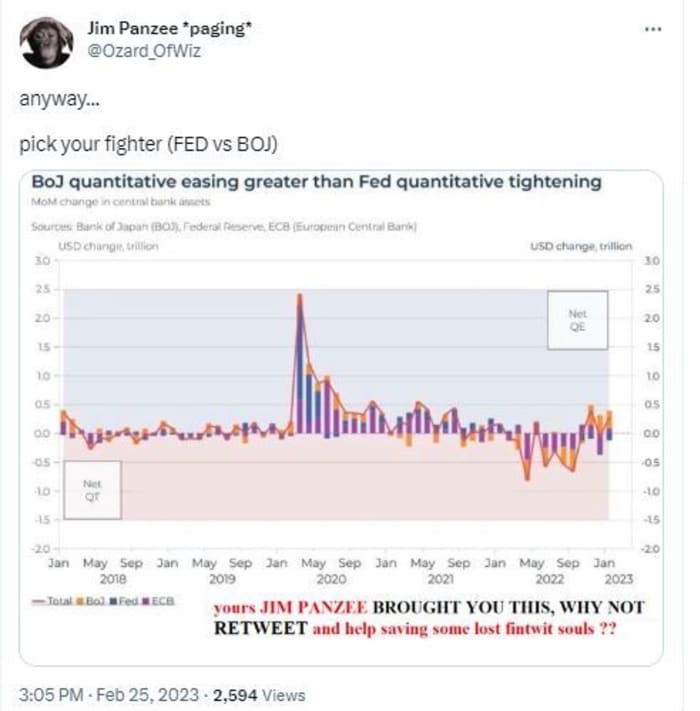

Right here’s one have a look at central financial institution efforts over the previous few years:

@Ozard_OfWiz

The tickers

These have been the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Safety title |

| TSLA | Tesla |

| BBBY | Mattress Bathtub & Past |

| AMC | AMC Leisure |

| GME | GameStop |

| TRKA | Troika Media |

| NIO | NIO |

| NVDA | Nvidia |

| APE | AMC Leisure Holdings |

| AAPL | Apple |

| AMZN | Amazon |

Random reads

Turkish soccer match turns into stuffed-toy bathe for earthquake-affected youngsters.

Don’t mess with the Kung Fu nuns of Nepal.

Have to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your e-mail field. The emailed model might be despatched out at about 7:30 a.m. Japanese.

Hearken to the Finest New Concepts in Cash podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton