Retail buyers have performed a necessary function within the rise of cryptocurrencies. Regardless of quite a few collapses and dangers, retailers proceed to carry crypto. However typically, at a excessive value and loss.

‘Retail buyers’ refers to particular person buyers who purchase and promote cryptocurrencies for his or her funding portfolios. In conventional finance (TradFi), retail buyers are known as ‘Predominant Avenue’. Comparatively, skilled and institutional buyers are referred to as ‘Wall Avenue’.

In cryptocurrency retail buyers have been instrumental in driving demand and infrequently lured by the seduction of ‘moonshot’ returns from crypto’s decentralized freedom of entry by anybody with an web connection.

This has led to elevated adoption and acceptance serving to set up crypto as a viable various asset class to conventional currencies. Contemplating, Bitcoin retail provide surged 17 p.c, roughly 3.57 million in Dec. 2022. Final yr, the market witnessed a number of collapses, corresponding to FTX. However, retailers had been undeterred. That is in keeping with on-chain analysis agency Glassnode shared by an analyst.

On the similar time, the proportion of feminine crypto buyers elevated from 24% within the first quarter of 2022 to 34% within the fourth quarter of 2022. These situations showcase retailers’ religion within the cryptocurrency sector.

As well as, retail buyers have performed a major function in creating the crypto ecosystem. Many retail buyers are additionally builders, entrepreneurs, and fans, actively concerned in constructing new blockchain-based functions and providers. Their contributions have helped to broaden the use instances for cryptocurrencies and created new alternatives for funding and innovation.

Retailers Have Suffered Over the Years

Nonetheless, it’s essential to notice the involvement of retail buyers has additionally introduced censure. Notably elevated volatility and danger to the cryptocurrency market. As extra folks have change into concerned in buying and selling cryptocurrencies, there have been extra vital worth fluctuations and elevated vulnerability to fraud.

The stated cohort confronted challenges and losses previously because of the collapses of varied monetary establishments and markets. One notable instance is the worldwide monetary disaster of 2008, which destroyed a number of giant monetary establishments and brought about vital losses for a lot of retail buyers. Many buyers misplaced their life financial savings and retirement funds because the inventory market plummeted, and the worth of many securities and monetary merchandise declined sharply.

Different examples of financial collapses which have affected retail buyers embrace the chapter of Enron in 2001 and the failure of Lehman Brothers in 2008. These occasions demonstrated the dangers and potential pitfalls of investing within the monetary markets. Most notably, these needing a deeper understanding of the complicated monetary merchandise and techniques concerned. Regardless of the challenges, retail buyers proceed to play an important function within the evolution of cryptocurrencies and the broader blockchain ecosystem.

Gracy Chen, the Managing Director of Bitget, spoke solely with BeInCrypto on the Dubai Blockchain Life 2023 occasion. Right here she highlighted retail buyers’ involvement in crypto and shared a couple of narratives to safeguard the cohort.

Ongoing Tendencies for Retail Merchants

Chen asserted that the retail funding pattern had progressed from the place it was eight years in the past. ‘Product-level updates are important in shaping at this time’s retail investor developments. First, the emergence of stablecoins has added an anchor to fiat currencies, which can be the cornerstone of varied spinoff merchandise. The emergence of perpetual contracts has additional elevated the steadiness and liquidity of crypto costs,’ she acknowledged.

Additional added:

“For merchants, perpetual contracts are a simple solution to take a leveraged place in a given market with no expiration date. As well as, buyers can reap the benefits of the perpetual funding charge to earn curiosity whereas minimizing the danger of the underlying asset. The reducing of the funding threshold and the simplification of merchandise allow extra buyers to take part in buying and selling crypto, which the market couldn’t present eight years in the past.”

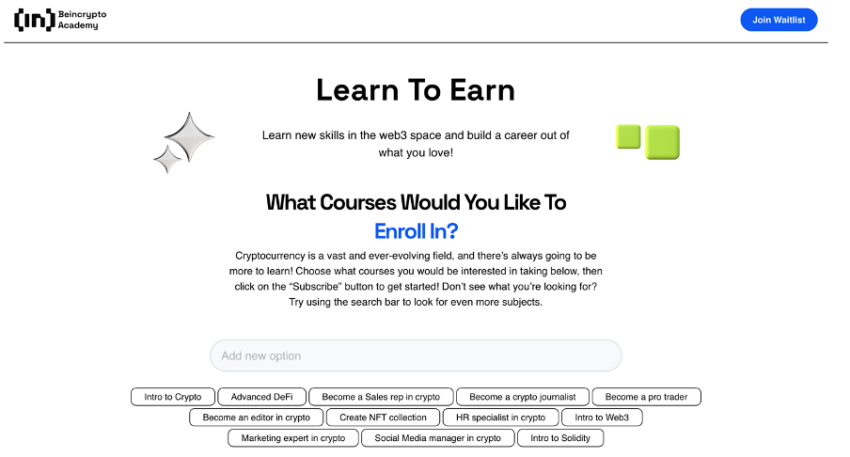

Moreover, crypto exchanges are taking part in an element in safeguarding and educating retailers. Bitget is not any totally different. Platforms corresponding to Bitget Academy, supply blockchain, crypto, and buying and selling training by way of in-depth guides, sensible suggestions, and market updates. Equally, BeInCrypto presents an academic useful resource too.

Defending Clients’ Funds and Cryptos

Whereas the area and holders have comparatively matured, hacks and collapses result in losses amounting to thousands and thousands. Due to this fact, crypto exchanges will need to have a system to guard customers’ funds. This will come in numerous initiatives. As an example, Bitget launched a $5 million builders’ fund to help affected companions, elevated Bitget Safety Fund to $300 million with clear pockets addresses, and assured no withdrawal for 3 years.

“The following factor we labored on was our Proof-of-Reserves. We have now developed an inner verification software, “Merklevalidator,” with free entry to open-source codes on GitHub. Not solely displaying reserve standing as a complete within the firm, customers can even confirm their account’s proof of reserves with the software. Proving our trade reserve to customers’ belongings is a minimum of on a 1:1 ratio.”

On a extra normal entrance, Crypto exchanges ought to have a number of safety measures in place to guard customers’ funds and cryptocurrencies.

Normal Safety Measures

- Two-Issue Authentication (2FA): Two-Issue Authentication provides an additional layer of safety to consumer accounts by requiring customers to enter a second issue, corresponding to a novel code despatched to their telephone or generated by a specialised app, along with their login credentials.

- SSL Encryption: SSL (Safe Sockets Layer) is a protocol to encrypt the communication between the consumer’s gadget and the trade’s servers. This prevents unauthorized entry to the consumer’s info and reduces the danger of knowledge breaches.

- Chilly Storage: Most crypto exchanges retailer the vast majority of consumer funds in offline wallets, which aren’t related to the web. This makes it troublesome for hackers to entry customers’ funds remotely.

- Multisignature Wallets: Multisignature wallets require a number of signatures from totally different people to provoke a transaction. This provides an additional layer of safety and makes it harder for hackers to entry customers’ funds.

- Common Audits and Penetration Testing: Crypto exchanges usually rent third-party safety companies to conduct their techniques’ common audits and penetration testing. This helps determine vulnerabilities and make sure the trade’s safety measures are efficient.

- Insurance coverage: Some exchanges might supply insurance coverage to their customers to guard in opposition to losses as a consequence of theft or hacking.

- Regulatory Compliance: Many crypto exchanges are topic to regulatory oversight, which requires them to implement particular safety measures to guard their customers’ funds and knowledge.

What Does the Future Look Like?

Retailers have an essential function to play within the crypto area. It’s important for retail buyers to fastidiously take into account the dangers and potential rewards of any funding alternative and to hunt skilled recommendation if wanted. Diversification and a long-term funding technique can even assist mitigate some dangers related to investing within the monetary markets.

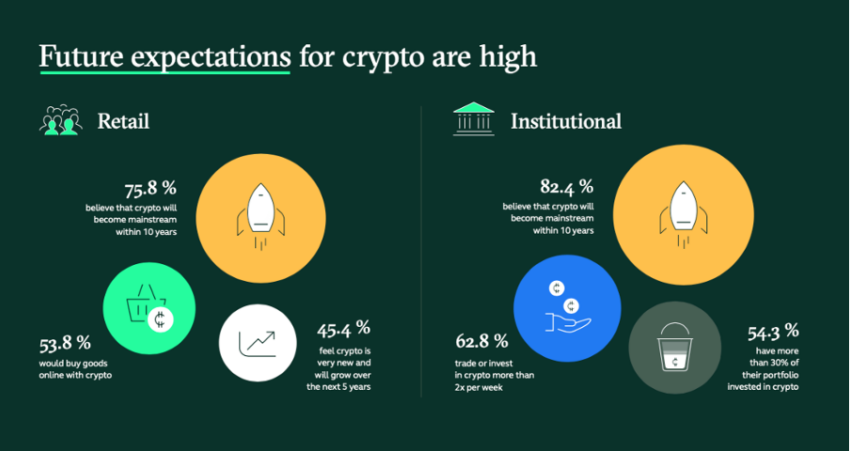

International cryptocurrency holders account for about 4.20% of the inhabitants, with over 400 million cryptocurrency customers in whole. The general market dimension remains to be comparatively small. Quite the opposite, the cryptocurrency market infrastructure has been repeatedly bettering, with growing centralized and decentralized platforms offering customers with a variety of funding, buying and selling, and cryptocurrency utilization choices. Utilization of Dapps (Decentralized apps), together with DeFi, NFTs, gaming, and social have gotten more and more numerous with extra industries getting concerned in web3.

The underlying performances of present chains are additionally enhancing, and increasingly more retail buyers will be predisposed to take part within the cryptocurrency market. “Within the subsequent 5-10 years, we count on exponential development within the variety of retail buyers within the Web3 area,” Chen concluded.

Disclaimer

All the knowledge contained on our web site is printed in good religion and for normal info functions solely. Any motion the reader takes upon the knowledge discovered on our web site is strictly at their very own danger.