The cryptocurrency market downturns of 2022 noticed the likes of Bitcoin shed their worth so drastically that even after months of regular restoration, many property stay greater than 50% adrift from their outdated all-time highs. Regardless of this, many crypto customers are readying for a parabolic Bitcoin rally in 2025. Are they proper to take action?

Bitcoin’s Historic Worth Efficiency

The world of cryptocurrency is famously unstable, so it may be remarkably troublesome for traders to establish tendencies and spot new bull markets rising. Regardless of this, one cyclical occasion, the Bitcoin halving occasion, which happens roughly each 4 years, stands out as carrying a serious influence on your entire crypto ecosystem.

As we will see from Bitcoin’s Historic efficiency, the value rallies the cryptocurrency skilled in 2021 look like extra of an anomaly, given how shortly their values had been wiped away via subsequent downturns.

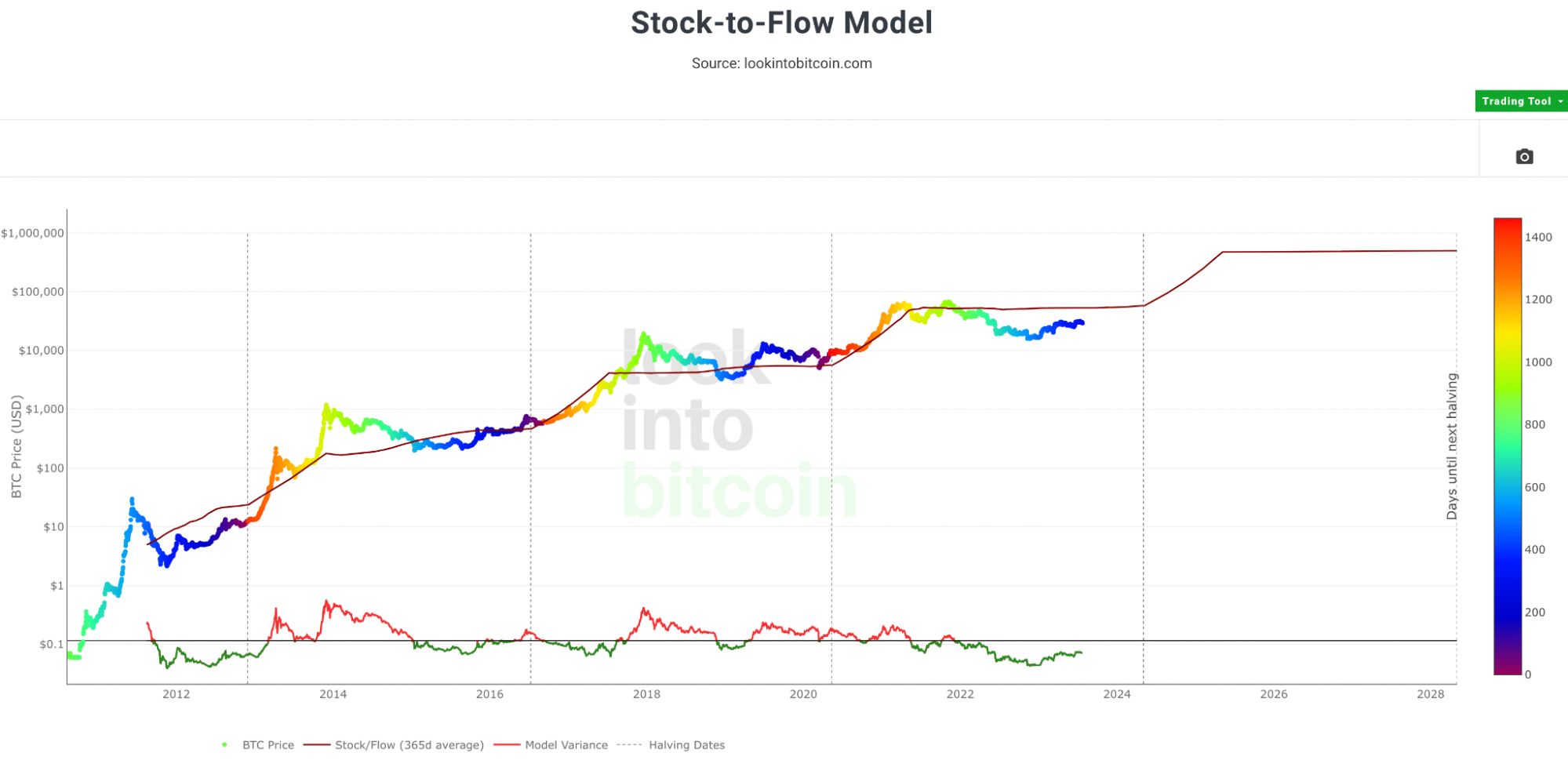

Nonetheless, analyzing tendencies like Bitcoin’s Inventory-to-Circulation (S2F) mannequin paints a distinct image. Ought to the tendencies of the previous be repeated, it might be that investor optimism for 2025 is totally justified.

Can Bitcoin Attain a File Worth?

After all, it is totally potential for Bitcoin to achieve a report worth. At current, Bitcoin’s all-time excessive (ATH) valuation stands at round $69,045. Nonetheless, following 2022’s widespread financial downturns, the world’s most well-known cryptocurrency is way adrift from its former ATH.

At a price of round $30k, Bitcoin’s market capitalization must greater than double simply to recapture its former glories. So how can crypto customers take into account if a brand new ATH is achievable in such a brief house of time?

For a lot of, new worth rallies usually are not solely potential, however additionally they have the potential to surpass earlier information far.

“If the upward pattern continues till 2025, [Bitcoin] may attain $102,554.10 and BTC might revenue,” writes Jason Connor, editor-in-chief at crypto evaluation web site Bitcoin Knowledge. “If the market experiences a decline, the purpose will not be met. BTC is anticipated to commerce at a mean worth of $93,763.75 and a low of $87,903.51 in 2025.”

Whereas breaking the $100,000 barrier could appear astronomical, Cathie Wooden’s Ark Make investments anticipates even larger worth actions over a extra long-term foundation.

In response to Ark Make investments, Bitcoin can climb to over $1 million by 2030.

Such a rare worth motion would wish BTC to extend by over 4,000% in seven years. Nonetheless, for an asset that is presently round 43,000% larger than its worth of $67.81 recorded in July 2013, this will likely not appear to be the enormous leap it first seems.

One of many core causes behind Bitcoin’s tendency to report meteoric worth rises lies inside its halving occasions. These pre-programmed mechanisms basically alter the asset’s shortage, making it rarer by design.

What’s Bitcoin Halving?

So, what’s a Bitcoin halving? When Bitcoin was initially developed by its pseudonymous founder, Satoshi Nakamoto, it was intentionally created to uphold a stage of shortage that will protect its worth over time.

So far, solely 21 million BTC will ever be “mined,” and greater than 19.4 million Bitcoin have entered circulation.

Regardless of there solely being 1.6 million BTC left to mine, it is anticipated the ultimate BTC might be minted onto the blockchain within the 12 months 2140. It is Bitcoin’s halving occasions that may trigger such a extreme slowdown.

Bitcoin’s halving occasions “halve” the quantity of BTC awarded to miners who mint the cryptocurrency by fixing complicated mathematical puzzles utilizing huge quantities of computational energy.

Whereas the block reward for Bitcoin miners stood at 50 BTC when the cryptocurrency was launched in 2009, this reward was halved to 25 4 years later in 2012. The latest halving occasion noticed the quantity of Bitcoin awarded to miners drop to six.25, and the subsequent one, penciled in for 2024, will see rewards fall additional to three.125 BTC.

Why Halving Impacts the Worth?

As a result of halving occasions scale back the quantity of BTC being minted by 50% each 4 years, the shortage of the forex routinely ramps up, sparking a elementary shift within the supply-to-demand of the token. This, traditionally talking, has resulted in a pattern whereby Bitcoin embarks on a worth rally that culminates in a brand new all-time excessive worth for the forex.

Observing Bitcoin’s stock-to-flow (S2F) mannequin, which is constructed on the variety of BTC accessible out there relative to the quantity being mined yearly, we will see that Bitcoin’s worth invariably rises within the months following a halving occasion, with new all-time excessive values recorded across the identical time within the wake of the occasion.

With the approaching Bitcoin halving occasion set for 2024, we will observe the S2F mannequin anticipate worth actions far in extra of $100,000 by 2025 ought to the correlation proceed to cling to its worth forecast.

Does this imply that Bitcoin will certainly be price greater than $100,000 by 2025? Whereas this cannot be answered with certainty, to fail to achieve a brand new ATH within the wake of its 2024 halving would be the first time Bitcoin has been unable to embark on a significant bull run following a halving because it was initially created.

Ought to You Make investments Now?

Naturally, this begs the query, is it time to spend money on Bitcoin earlier than the halving? Though tangible tendencies clearly present Bitcoin’s kind in terms of post-halving worth rallies, it is also price staying cautious.

Bitcoin’s most up-to-date bull run in 2021 was weaker than first anticipated amongst S2F forecasts and was buoyed by a widespread increase interval for tech shares and shares pushed by the discharge of presidency stimulus packages to assist the Covid-19 pandemic restoration. This implies Bitcoin’s most up-to-date post-halving occasion increase might have coincided with different optimistic market tendencies.

As Bitcoin continues to win mainstream acceptance, its post-halving bull run energy might weaken, with extra long-term institutional holders paving the way in which for much less volatility all through the market.

So, sure, Bitcoin’s halving occasion is a justifiable trigger for excellent market-wide optimism. However, as ever in such a brand new and chaotic financial ecosystem, nothing’s sure in crypto.

The knowledge on this web site doesn’t represent monetary recommendation, funding recommendation, or buying and selling recommendation, and shouldn’t be thought-about as such. MakeUseOf doesn’t advise on any buying and selling or investing issues and doesn’t advise that any explicit cryptocurrency must be purchased or offered. All the time conduct your personal due diligence and seek the advice of a licensed monetary adviser for funding recommendation.